Why Oil Prices Will Rise More and Sooner Than Most Believe

By: David Yager

Posted by: Energy Now Media

Posted by: Energy Now Media

As the September 26 to 28 “informal” meeting of OPEC producers (and apparently Russia) in Algeria draws near, media speculation could easily cause mental anguish. On oil news websites the same home page simultaneously carries headlines claiming OPEC will both fail and succeed in capping output. One can be forgiven if you read all this stuff and cannot comprehend what it means.

Called by OPEC August 8, the stated purpose of the gathering was, “OPEC continues to monitor developments closely, and is in constant deliberations with all member states on ways and means to help restore stability to the oil market”. Obviously that is the view of the organization, not the member countries. Iran and Saudi Arabia remain at loggerheads over which will exert the most influence in the Persian Gulf. Iraq, Nigeria, Libya and Venezuela are all experiencing various forms of internal meltdown which thankfully (massive human suffering aside) is keeping a lot of oil off the market.

But as recently as September 20, OPEC Secretary-General Mohammed Barkindo was talking publicly about a one-year production freeze among OPEC members and producers like Russia. When it announced the meeting in early August OPEC believed non-OPEC production would fall by 1 million b/d this year from 2015 and a bit more in 2017. Even the most pessimistic estimates for demand growth see 1.2 million b/d this year and next. But there is no consensus on these numbers.

At some point global supply/demand curves will cross and prices will rise. Some data indicates they already have. With low oil prices causing massive cutbacks in spending on new supplies everyone agrees oil prices are very unlikely to revisit recent record lows and will rise over time. The question is how much and when. The rest of this article is dedicated to the premise nobody actually knows. As the working oilpatch remains inundated with bad news, this means something good could easily occur.

On September 14 Goldman Sachs Group Inc. analyst Jeff Currie opined there would be no price rally anytime soon. In a Bloomberg article Currie is quoted as saying the risk is “to the downside” in the absence of any major drivers to make prices rise. The result is that for the next year WTI will be stuck in the US$45 to US$50 range. Curry said, “It really looks similar to the period of the early 1990s, when we were at US$20 oil. Is US$45 to US$50 the new US$20? I am not ready to say we are in this new equilibrium environment, but it sure does feel that we’re moving in that direction”.

As happens every day when any news one way or another is released, oil markets responded and WTI moved. In this case it fell. Crude has been generally down for the past two weeks since WTI reached a recent high of US$47.83 on September 8 although it recovered somewhat September 20 and 21 on U.S. inventory declines.

The problem with the Goldman thesis is global oil markets today look nothing like they did in the early 1990s. Then oil was half-way through an extended period of low prices from 1985 to 2004. It is quite common to say oil markets are similar to what they were 20 and even 30 years ago. Except it’s wrong. Review the following and reach your own conclusion.

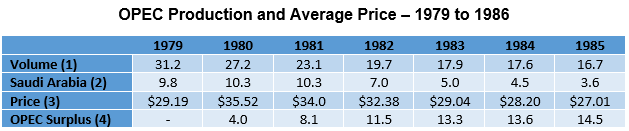

- BP Statistical Energy Report 2004, millions of barrels per day annual average

- BP Statistical Energy Report 2004, millions of barrels per day annual average

- The Statistics Portal, average OPEC oil price US$ for that year

- Implied OPEC surplus capacity current year versus 1979

In 1986 the average OPEC price was only $US13.53, 40% of recent peaks. This is sort of like today. But note the market overhang in 1985. Using today’s price drivers oil would have negative value. While the Iran/Iraq war from 1980 to 1988 pulled a lot of oil off the market, note that to hold the price above US$27 in the first five years of the 1980s Saudi Arabia shut in 7 million b/d. Now that’s a swing producer! OPEC would not see the 1985 average price for 18 years. Whatever the Saudis may or not be doing today, they only have a tiny fraction of this excess capacity now, if any.

The cause of this oil price collapse was a massive surge in non-OPEC production, the result of record high oil prices (10X increase over 10 years) and the determination of the rest of the world not be held hostage by OPEC.

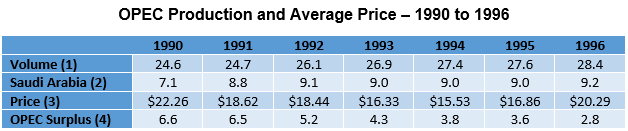

- BP Statistical Energy Report 2004, millions of barrels per day annual average

- BP Statistical Energy Report 2004, millions of barrels per day annual average

- The Statistics Portal, average OPEC oil price US$ for that year

- Implied OPEC surplus capacity current year versus 1979

The first Gulf War in 1991 resulted in chaos in Iraq and the oil fires of Kuwait. But this seemed to have no measurable impact on total OPEC output which rose annually thereafter. Total non-OPEC production in 1973, when OPEC started flexing its muscles, was only 19.8 million b/d. Twenty years later it was 30.9 million b/d, over 50% higher. The rest of the world effectively squeezed OPEC out of the market causing a price collapse that lasted for nearly 20 years.

An extended period of low oil prices created the market conditions for 10 years of much higher oil prices from 2004 to 2014. One was continued growth in demand and the other was a flattening of non-OPEC production growth. In 2006 a research report from the Oxford Institute for Energy Studies revealed global spare production capacity which had peaked at an estimated 10 million b/d in 1985 had shrunk to almost zero by 2004. In 2000 OPEC output was back above 30 million b/d for the first time since 1979, 21 long years later.

Which is why today’s world oil markets look a lot more like 2003 than 1993. According to OPEC’s monthly World Oil Supply report total output for August was 33.2 million b/d, a record. This is up over 2 million b/d from 2014 with the major contributors being Iran (1 million b/d), Iraq (1.1 million b/d) and Saudi Arabia (1 million b/d). This difference was offset by declines in Venezuela, Algeria, Libya and Nigeria.

Since OPEC has had no quota for nearly two years and the stated game has been volume, not price, one can safely assume OPEC’s current spare capacity is effectively zero. While an unlikely outbreak of peace and tranquility in one or more troubled OPEC member countries could put more oil the market, because of the nations involved is it extremely unlikely all countries will ever produce at full capacity at the same time.

Goldman Sachs is not alone in predicting “lower for longer”. This is what almost everybody says. On September 20 the Financial Post reported RBC Capital Markets was of the view oil prices would indeed rise but not until 2019. RBC says 2.2 million b/d of new non-OPEC production will enter the markets this year, 1.3 million b/d next year and 1.6 million b/d in 2018. Somehow U.S. production will rise by 900,000 b/d from 2017 and 2019 despite falling by 1.1 million b/d in the past 15 months and with rigs count at historic lows. At the same time RBC reported the 124 E&P companies it follows will cut spending another 32% in 2016 from 2015, a $US106 billion reduction.

However, not everybody is saying what you see is what you get. On September 14 the Financial Post picked up an article from The Telegraph and ran it under the title, “When oil turns it will be with such lightning speed that it could upend the market again”. Citing the lowest levels of oil discoveries since 1952, annual investment in new supplies down 42% in the past two years and how the International Energy Agency (IEA) estimates 9% average annual global reservoir depletion, the article stated, “…the global economy is becoming dangerously reliant on crude supply from political hotspots”. “Drillers are not finding enough oil to replace these (depletion) barrels, preparing the ground for an oil price spike and raising serious questions about energy security”.

Depletion of 9% per year is about 8.6 million b/d. Add demand growth and you’re approaching 10 million b/d. How do the crystal ball polishers of the world who see flat oil prices for the foreseeable future figure producers can replace this output when others report $US1 trillion in capital projects have been cancelled or delayed of the rest of the decade? Exploration and production companies must replace reserves or they go out of business.

An interesting article on oilprice.com September 19 was titled, “Is U.S. Shale Nearing Collapse?” It pointed out that if intensive drilling in the highly prolific Permian Basin were deducted, the 10% decline in U.S. crude output in the past year would in fact by 33%. The article figures the capital being directed to the Permian Basin will not be enough to sustain U.S. output, let alone cause it to grow. For the U.S. to add 4 million b/d of light tight oil to global markets this decade required an average 1,370 rigs drilling every day for nearly four years from June 2011 to February 2015. Despite endless musing about efficiency gains and high-graded reservoirs, the 416 rigs drilling for oil in the U.S. Friday September 16 according to the weekly Baker Hughes report will not be able to sustain production let alone increase it.

The last ingredient in the oil price confusion in inventory levels. OECD countries currently hold 3.1 billion barrels of oil inventory. That sounds like lot. But what nobody reports is the five-year average is about 2.7 billion barrels. Refinery storage tanks. Pipelines. Field locations. Tankers in transit. It’s huge. The current overhang is about 6 days of production higher than it has been for years, about 60 days. So inventories are up roughly 10% from where they have been.

Obviously this is going to take a change in the global supply/demand balance to return to historic levels and will dampen prices until it does. But anybody who thinks OECD inventories must go to zero for oil prices to rise understand nothing about oil markets. With no oil is storage for tomorrow’s supply chain crude would fetch $1,000+ or more and the world’s economy would collapse.

What we do know is the global oil data avalanche is relentless and each and every one causes oil prices to wiggle. That’s because making money trading is, at least volumetrically, a much bigger business than finding and producing the product. The Chicago Mercantile Exchange (CME) brags, “Trade Light Sweet Crude Oil (WTI), the world’s most actively traded energy product”. And trade they do. On February 10, 2016 the CME alone (other exchanges also trade WTI) traded a record 1,609,771 WTI contracts of 1,000 barrels each. That day 1.6 billion “dry barrels” were traded while actual North America production, which is priced off WTI, was less than 13 million “wet barrels” of actual oil. This means on that day 123 “futures market” barrels were traded for every barrel produced. On just the CME.

This assures financially engineered volatility. It’s gotta move or this new industry has nothing to do. Markets are now conditioned to scheduled weekly data releases which cause prices to change. Which is of course good for traders. On Tuesday the American Petroleum Institute releases U.S. oil inventories. The Energy Information Administration (EIA) does the same thing Wednesday. The Baker Hughes rig count is every Friday. The International Energy Agency does its global oil/supply demand report mid-month. All releases are scheduled down to the minute. Knowing the market is going to move and money will be made or lost by speculators, data providers understand their obligation to ensure a level playing field. This leads to reams of trade speculation leading up to each and every release, voluminous analysis thereafter, and an oil price vacillation one way or the other almost immediately as traders shift their bets based on the latest snippets of data.

The weekly reports from the U.S. Commodity Future Trading Commission where traders must disclose their activity show the wagers are both long and short. That’s what hedge funds do. But even a change in the number of futures on either side of the trade is now newsworthy as to whether the dry barrel speculators think oil will go up or down. That futures trading was invented so producers could lock in a stable future cash flow is long forgotten. After all, they can only hedge the wet barrels they believe they will produce, a tiny fraction of the activity in modern commodities.

The current production overhang suppressing markets is only about 1 million b/d or less depending upon which forecast you’re looking at. Both the IEA (Paris) and the EIA (Washington) see the curves very close if they haven’t crossed already. Neither agency sees any overhang by the end of the next year. That’s why today’s macro-oil markets bear no resemblance to those of the past other than unprecedented levels of trading and speculation.

Lost in the oil prices trees is the global market forest. OPEC has no meaningful excess capacity. Non-OPEC production is flat out and, in the face of massive spending cuts, is more likely to fall than rise because production increases will be more than offset by natural reservoir depletion rates. Demand will continue to increase despite the well-publicized public relations campaign by the anti-carbon crowd claiming oil has no future. Commodity traders only care about what will happen to prices in the next 10 minutes or 10 months, not the next 10 years. This creates a price which forces everybody in the business for the long haul – producers, service providers, equity investors and lenders – to make the wrong decisions.

Oil prices must and will go up. Okay, when? In reading everything about this subject for years it appears the number one driver of oil prices nowadays is not necessarily all the numbers we are bombarded with but the sentiment of investors. In today’s markets oil will rise when future traders figure they will lose more money going short than long. This hasn’t happened yet but the fundamentals ensure it will. And when it does commodities traders will pile in and WTI will blow through US$60 quickly and likely not slow down thereafter, setting the stage for another massive ramp up ensuring another crash. After all, volatility is not only assured but required.

About David Yager – Yager Management Ltd.

Based in Calgary, Alberta, David Yager is a former oilfield services executive and the principle of Yager Management Ltd. Yager Management provides management consultancy services to the oilfield services industry in a number of areas including M&A, Strategic Planning, Restructuring and Marketing. He has been writing about the upstream oil and gas industry and energy policy and issues since 1979

Comments

Post a Comment